Cyber Insurance and Its Importance in Security Operations

Introduction

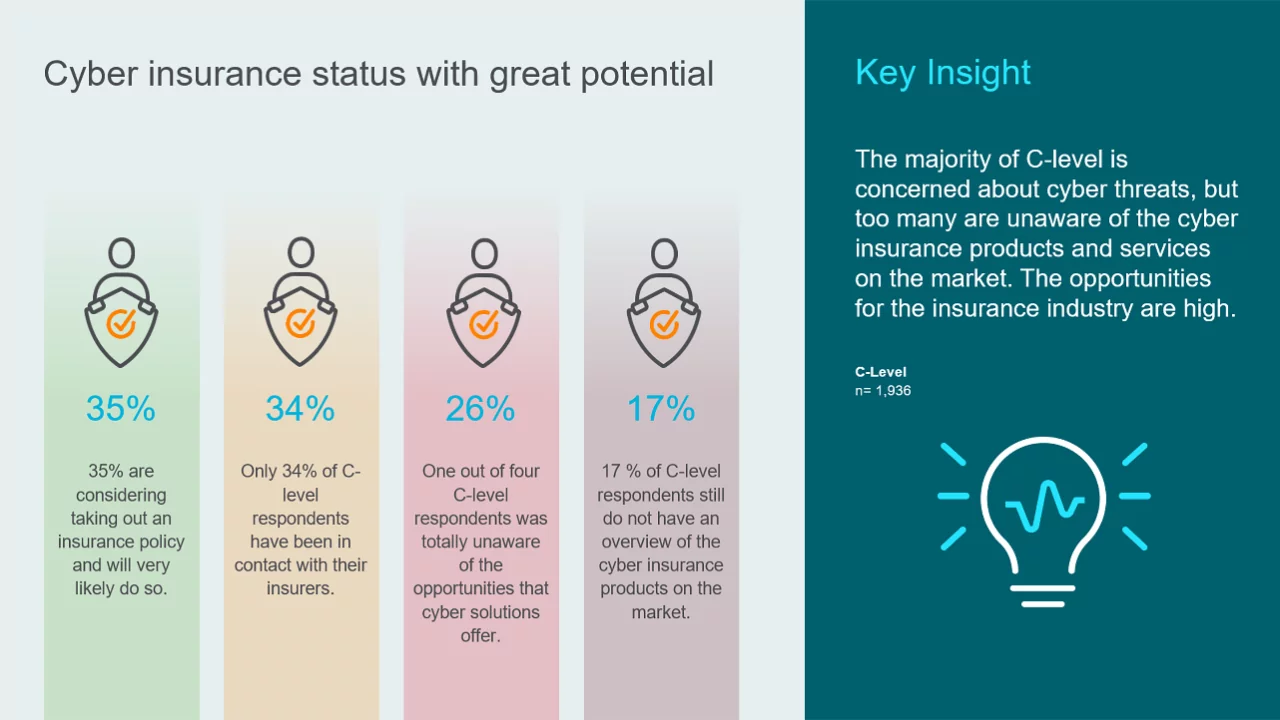

Nowadays, cyberattacks are very common in corporations. Because of this, businesses are turning to cybersecurity solutions and cyber insurance as a way to safeguard themselves from the negative repercussions of data breaches. Cyber incidents of various intensities and kinds occur every day all over the world.

The frequency of data breaches and other cybercrimes is rising. Recent significant data breaches have cost a cheap shopping chain, one of the biggest banks in the nation, renowned health insurance, an entertainment network, and the federal government in fines and legal expenditures. However, small businesses are also at risk from viruses and hackers. 55% of small organizations have experienced a data breach, and 53% have experienced several breaches. More than just your computer system, a small-business data breach can harm your reputation and endanger your clients and staff. To safeguard themselves, every organization should think about purchasing cyber insurance.

Source: Munich Re

The purpose of this article is to explain what cyber insurance is and how it works, as well as the different types of cyber insurance and why your organization should have it.

What is Cyber Insurance?

A plan called cyber insurance enables businesses to avoid the negative effects of a cyberattack or security breach. In addition to minimizing disruption in business after a cyber incident, a cyber insurance policy may help cover the costs of elements involved in the attack. It is common for cyber insurance policies to change every month because cyber risks vary and are dynamic. Cyber insurance buyers are considered early adopters in this young and expanding market. To determine coverage, costs, and premiums, underwriters for cybersecurity insurance policies need to create risk models using the little information available.

Types of Cyber Insurance

- First Party Expenses

- Regulatory Investigation Cover

- Crisis Management Expenses

- Privacy and Data Liability Claims

Source: Enterslice

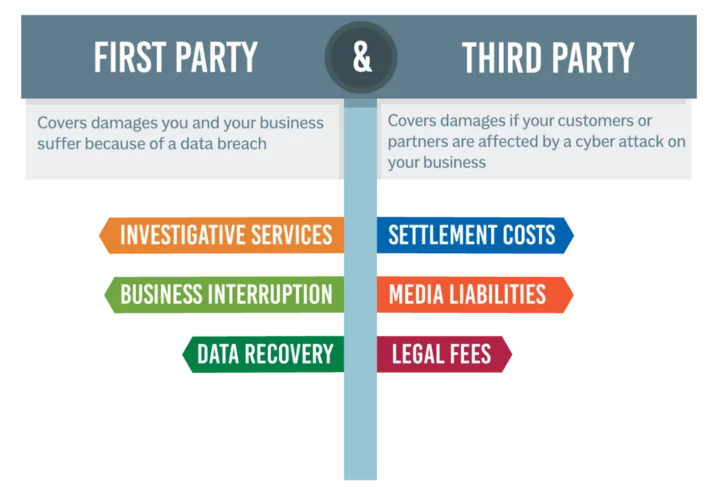

First-Party Expenses

First-party cyber liability insurance helps to mitigate the impact of data breaches and cyberattacks on your small business. As part of the recovery process, it covers the costs associated with communicating with affected customers, providing credit monitoring, managing PR (Public Relations) and reputation campaigns, and other recovery activities.

Source: Andrew Long Medium

If an employee writes down a password and leaves it visible, there could be a data breach. First-party cyber insurance could aid in defraying costs associated with incident-related costs, such as customer notification and credit monitoring, in the event that client information is taken.

Regulatory Investigation Cover

A regulatory liability policy is intended to cover losses incurred by a company as a result of regulatory investigations and claims. This coverage is, therefore, only partially a liability policy. The cost of interacting with state and federal regulatory agencies (charged with enforcing data breach laws and regulations), including the cost of hiring attorneys to advise regulators during investigations and the cost of paying regulatory fines and penalties, is covered by privacy regulatory coverage while other liability coverage only covers the cost of responding to third-party claims.

Crisis Management Expenses

A policy covers technology errors and omissions, internet and online property, and liability. Crisis management coverage generally reimburses expenses incurred to restore confidence in the security of the insured’s computer system, subject to a sub-limit (e.g., $25,000–$50,000). In response to a breach of an online retailer’s security system, the retailer might hire a crisis management firm to reassure its customers that the system has been reconfigured to prevent future breaches.

Privacy and Data Liability Claims

It covers a company’s third-party legal liability for damages resulting directly from an error on the company’s part or from a privacy, data, or security breach that may cause defamation, intellectual property (IPR) infringement, and litigation. In other words, this is a type of insurance designed to protect consumers of technology products and services. In particular, the policies cover liability and property losses that may arise when a business engages in various electronic activities, such as selling on the internet or collecting data within its own electronic network.

As a matter of fact, cyber and privacy policies cover a business’ liabilities when its customers’ personal information is exposed or stolen by hackers or other criminals who have gained access to the firm’s electronic network as a result of a data breach. These policies cover a variety of expenses associated with data breaches, including notification costs, credit monitoring, fines and penalties, and identity theft losses.

Source: isure

Features of Cyber Insurance

- In the event that counseling services are required by the insured as a result of a cyberattack, this policy will pay for the reasonable cost of treatment.

- Cyber insurance covers the costs of IT consulting services, as well as the reasonable cost of counseling services if the insured requires such services due to a cyber-attack.

- Provides reimbursement for restoration costs following malware attacks and covers financial damage from IT theft, phishing, and email spoofing.

- It provides defense, prosecution, and transportation & copying costs in case of identity theft, social media liability, and media liability cyber-attacks.

- Authentication of digitally written communications through email or any other authentic source via electronic means is considered part of this policy.

- We can choose from a wide variety of coverage options at affordable premiums (starting from INR 700), as well as from a range of sum insured options between INR 1 lakh and INR 100 lakhs.

Importance of Cyber Insurance

In the event of a cyberattack or incident, organizations can suffer electronic data loss, compromise, or theft. These losses can negatively impact businesses, resulting in lost revenue and customers. To protect themselves against cyber events, such as terrorist attacks, organizations need cyber liability insurance. It can assist in reducing the duration of the crisis.

For example, hackers exposed the personally identifiable information (PII) of 77 million PlayStation user accounts in 2011 when they gained access to Sony’s PlayStation Network. Users of PlayStation consoles were unable to access the service due to the vulnerability, which resulted in a 23-day outage. Sony spent more than $171 million on expenses because of the incident. This cost might have been partially covered by a cyber insurance policy, but Sony lacked one. After a judge ruled that Sony’s insurance only covered damage to physical property, Sony was left to cover the whole cost of any cyber losses.

Conclusion:

Cyber insurance coverage will not only protect you in the event of a cyberattack, but it will also assist you in preventing it by lowering the likelihood that it will occur. Make your online environment as secure as you can before investing in cyber insurance coverage. Maintain a backup of your vital data and spend money on reliable firewalls and antivirus programs. When transacting online, be always vigilant and observant. Given that cyberattacks can have serious repercussions for both people and corporations, it is crucial to be ready for them.

Reference Links:

- TechTarget

- HDFC Ergo

Author,

Purnachandrarao Sunkara,

MSOC Department,

Varutra Consulting Pvt. Ltd.